Income Analysis

![]()

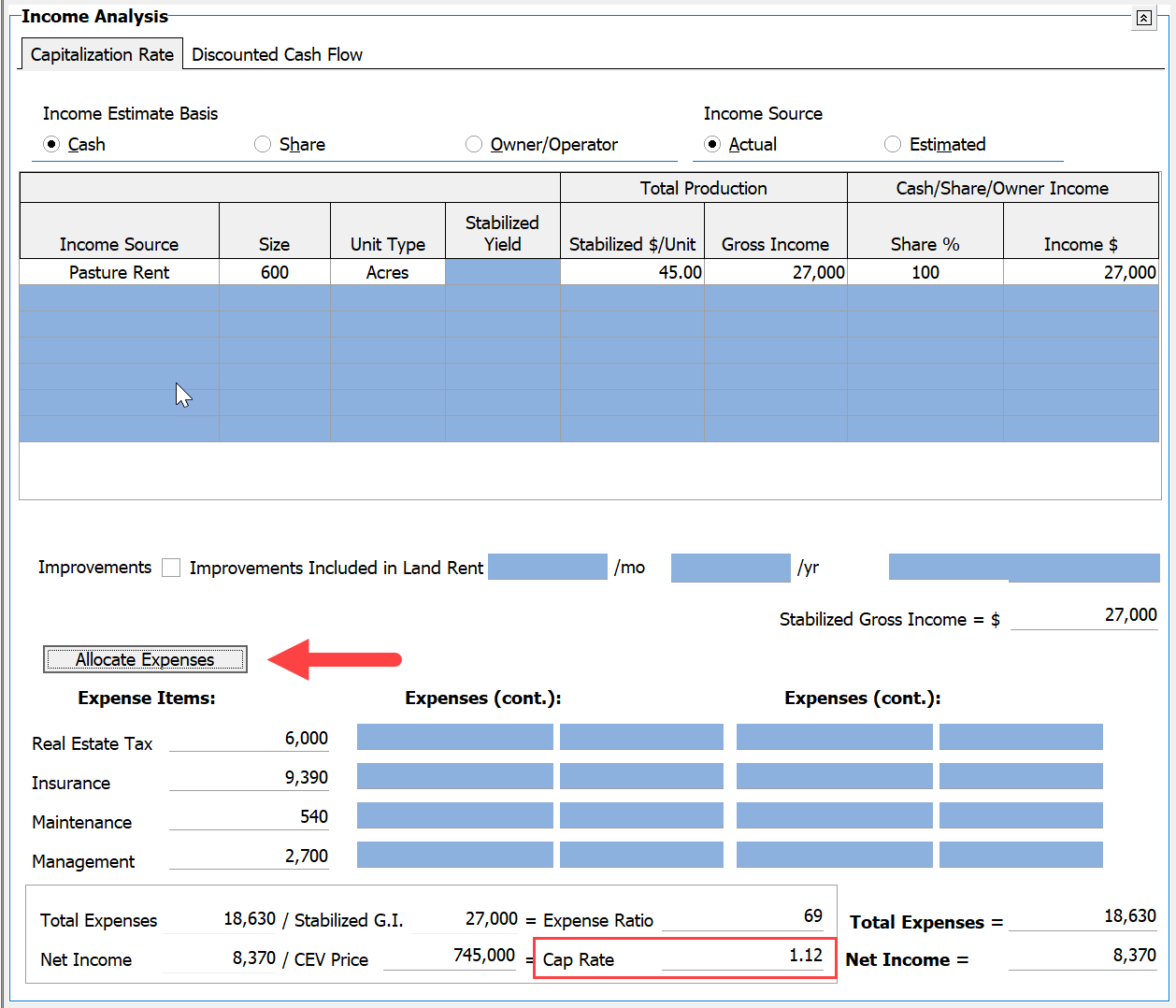

This is the Income Analysis section with sample data displayed.

The Allocate Expenses button and the location of the calculated Cap Rate.

Data points entered for the example above include:

- Cash basis

- Income source – it could be Pasture Rent, for example

- Units- meaning number of units as based on Unit Measure

- Acre

- Stabilized $/Unit – $45.00

- 100% Share

The stabilized gross income calculated automatically to $27,000.

Expenses are addressed next.

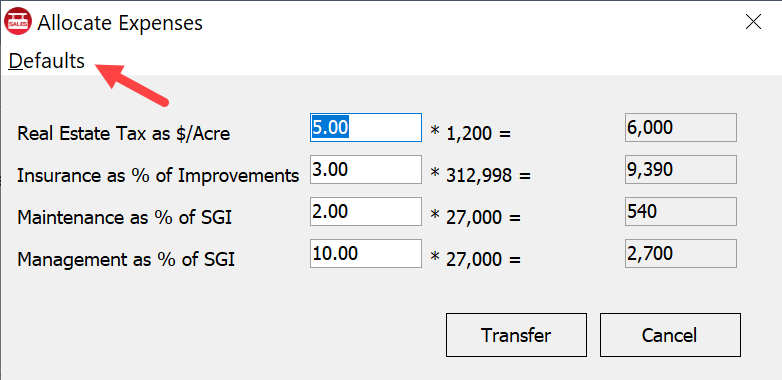

Default options include real estate tax, insurance, maintenance, and management costs.

There are additional fields for more expenses and their values. Sample data entered for the above example include:

- RE Tax = $6,000 This is calculated as $/Acre

- Insurance = $9,390 This is calculated as a percentage of total improvements

- Maintenance = $540 Calculated as a percentage of the Stabilized Gross Income (SGI)

- Management = $2,700 Calculated as a percentage of the Stabilized Gross Income (SGI)

Clicking the Allocate Expenses button will open a dialog box that is helpful for calculating the values for the defaults. The values can be transferred back to the Income Analysis section by clicking the Transfer button.

|

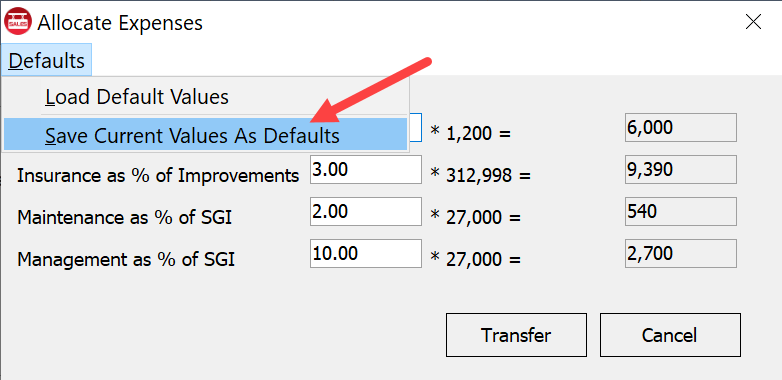

To save the values as a default, click the Defaults button.

|

Select Save Current Values as Defaults.

|